Introduction

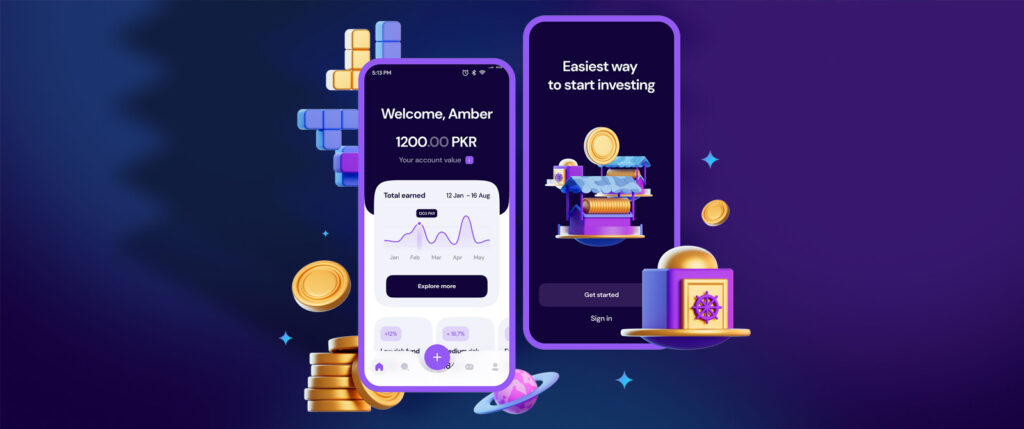

Trikl Pakistan is the very first digital asset management company. Regulated by the Securities Exchange Commission of Pakistan (SECP) under the RSB 2019 regulations and NBFC rules, 2003, Trikl has set new standards in the financial sector by offering a range of innovative services and products. It made it easier to invest in mutual funds.

Trikl Pakistan Digital Distributor of Mutual Funds:

Trikl has made it easier than ever for Pakistanis to invest in financial instruments. Leveraging technology has eliminated many barriers that previously made it difficult for people to enter the world of mutual funds. This has elevated investing, allowing a broader spectrum of people to participate in wealth-building opportunities.

Also see: An overview of life in South Korea

Trikl Pakistan Funds: One of Its standout features is the launch of its funds. These funds cater to various investment preferences, including Shariah-compliant and conventional options. As of November 24th, 2023, the partnership between Trikl and Bank Alfalah has been canceled.

Now Trikl offers two types of mutual funds:

Trikl Savings Fund (Conventional)

Trikl Islamic Daily Profit Fund

Trikl Savings Fund: Conventional Option

Trikl launched a savings fund on the 4th of July,2023 for those who prefer conventional investments based on interest or riba. This fund provides a straightforward investment opportunity for those who may not have specific Shariah compliance requirements but still want to achieve their financial goals. The current return rate on this fund is 22.1%.

NAV: 101.3933

Risk: Low

Management Fee: 0.25%

Launch Date: 4th July, 2023

Return per annum: 22.1%

Trikl Islamic Daily Profit Fund: Shariah Compliant

The objective of Trikl Islamic Daily Profit Fund (TIDPF) is to generate competitive returns within a Shariah-compliant, low-risk portfolio to provide a regular stream of income and easy liquidity to its investors.

NAV: 100

Risk: Low

Management Fee: 0.25%

Launch Date: 16th November 2023

Return per annum: 19.5%

Account Creation

The account creation process is straightforward. You must have a valid CNIC, register a SIM card under your CNIC, and provide a valid email address.

Procedure

- Verify your phone number.

- Verify your email address.

- Add front and back pictures of CNIC.

- Add a selfie for verification.

- Enter personal details such as home address.

The verification process takes about an hour; if there are any errors or omissions, Trikl’s team will notify you via email.

Deposit and Withdrawal:

- Any debit card can make deposits, but we recommend Sadapay debit MasterCard, as there are no charges over it.

- Recently, they added the IBFT deposit and withdrawal method.

- Once you place a withdrawal request, it is settled in T+2 days (working days), just like deposits. The withdrawal amount is reversed to the card from which you made the transaction.

Other Features:

Expense Tracking: The expense planner feature offers a robust expense tracking system that allows users to record their daily expenditures easily. Users can categorize expenses, add descriptions, and specify payment methods for each transaction.

Income Tracking: Besides tracking expenses, the app allows users to monitor their income sources. Users can add multiple income streams, set recurring income entries, and view their overall financial picture with a comprehensive income summary.

Why Trikl Pakistan?

Conventional and Islamic banks offer mutual funds, too, but the minimum investment amount starts from 200,000 rupees, in addition to this. You have to pay the front and back end loads. While on Trikl, there’s no such thing as that. Trikl plays a key role in providing access to financial money markets and awareness.

It was great seeing how much work you put into it. Even though the design is nice and the writing is stylish, you seem to be having trouble with it. I think you should really try sending the next article. I’ll definitely be back for more of the same if you protect this hike.

Pingback: New 46 Ways of Online Earning in Pakistan Without Investment