Just bought a new phone? You need to understand PTA taxes. PTA taxes ensure your device is registered and functional in Pakistan. This guide will help you check PTA tax and use your phone without any issues. Follow these steps to avoid any problems with your new phone.

This article will help you navigate official government websites and effectively use the PTA tax calculator to determine applicable taxes for your mobile device in Pakistan.

Understanding PTA taxes is crucial as they are imposed by the Pakistan Telecommunication Authority (PTA) to regulate mobile devices being used in the country. This helps in ensuring that all devices are legally brought into the country and helps in tracking the imports and use of mobile devices.

How Much is the PTA Tax on iPhone?

iPhone 11 PTA Tax in Pakistan

| iPhone 11 | PTA Mobile Tax on Passport (Rs) | PTA Mobile Tax on CNIC (Rs) |

|---|---|---|

| iPhone 11 | 67,308 | 86,689 |

| iPhone 11 Pro | 93,180 | 115,148 |

| iPhone 11 Pro Max | 96,860 | 119,196 |

iPhone 13 PTA Tax in Pakistan

| iPhone 13 | PTA Mobile Tax on Passport (Rs) | PTA Mobile Tax on CNIC (Rs) |

|---|---|---|

| Apple iPhone 13 | 90,800 | 118,400 |

| Apple iPhone 13 Pro | 105,700 | 128,800 |

| Apple iPhone 13 Pro Max | 110,400 | 137,900 |

iPhone 15 PTA Tax in Pakistan

| iPhone Model | PTA Mobile Tax on Passport (PKR) | PTA Mobile Tax on CNIC (PKR) |

|---|---|---|

| Apple iPhone 15 | 107,325 | 130,708 |

| Apple iPhone 15 Plus | 113,075 | 137,033 |

| Apple iPhone 15 Pro | 135,300 | 161,480 |

| Apple iPhone 15 Pro Max | 148,500 | 176,000 |

Step-by-Step Process to Check Mobile Registration

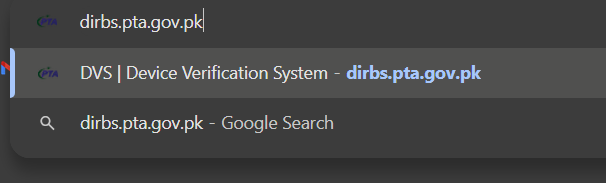

Step 1: Access the Device Verification System of PTA

Open your preferred browser on mobile or desktop. Navigate to the PTA official website or you can utilize the following link. This link will direct you to the Device Verification System (DVS) where you can check the status of your device.

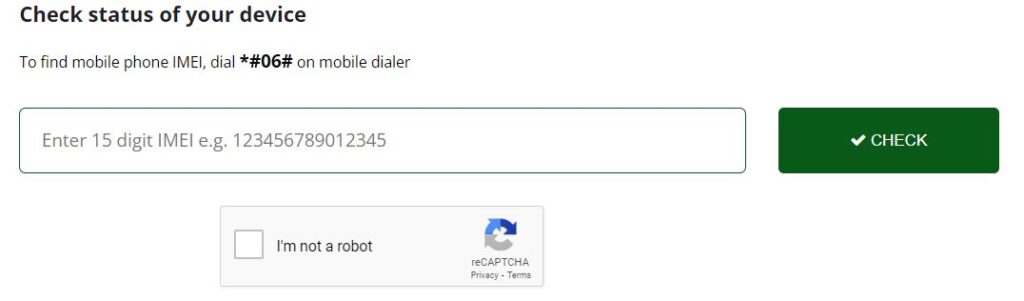

Step 2: Find the “Check Your Device Status” Option

Scroll down a little and you will ” check the status of your device ” bar. This bar is prominently displayed on the page and is easy to locate.

Step 3: Enter Your Device’s IMEI Number

Enter the IMEI number of your device. It is a 15-digit number that is unique and different for every device. This number can usually be found in the settings of your device, on the box it came in, or by dialing *#06#.

Step 4: Pass the reCaptcha Test

Once you’ve entered your IMEI number(s), don’t forget to check the captcha box to confirm you’re human. After that, simply click the ‘Check’ button to submit your details. This step ensures that the system is protected from automated bots.

Step 5: Review the Mobile Status

On the next screen, the PTA tax status of your mobile device comes alive. Devices with cleared PTCL invoices will display a reassuring green line, while those not meeting the requirements will show a stern red cross. Pay close attention to the results—it’s the signal indicating your device’s status.

Checking PTA TAX Status Via SMS

| Step Number | Action | Friendly Tip |

|---|---|---|

| 1 | Dial *#06# on your mobile | This code quickly shows your phone’s IMEI number. Make sure to write it down! |

| 2 | Send the 15-digit IMEI number to 8484 | Just like sending a regular SMS. Easy, right? |

| 3 | Wait for a response | You’ll receive a text with all the details about your phone’s TAX status. Sit tight, it’ll arrive shortly! |

How to Calculate PTA Tax?

The PTA mobile tax amount varies based on your phone’s declared value, typically ranging between 17% to 32%. It differs for registration via Passport and CNIC. Mobile prices may vary by city and online platforms. Stay informed with the latest PTA mobile tax rates in Pakistan.

| Mobile Phones having C&F value (USD) | Fixed-Rate (Amount in PKR) |

| Up to 30 | 1,230 |

| Above 30 and up to 100 | 6,400 |

| Above 100 and up to 200 | 17,280 |

| Above 200 and up to 350 | 23,800+17% GST |

| Above 350 and up to 500 | 34,000+17% GST |

| Above 500 and up to 700 | 52,000+17% GST |

| Above 700 | 60,000+17% GST |

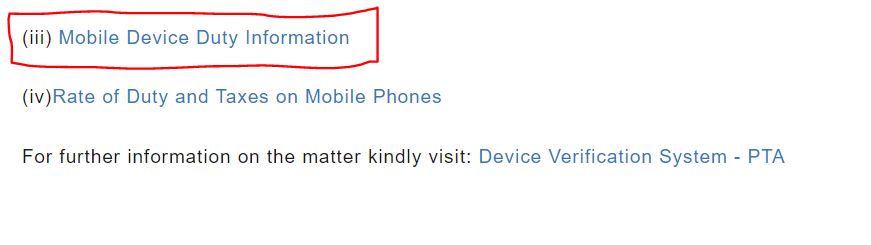

PTA Tax Calculator 2024

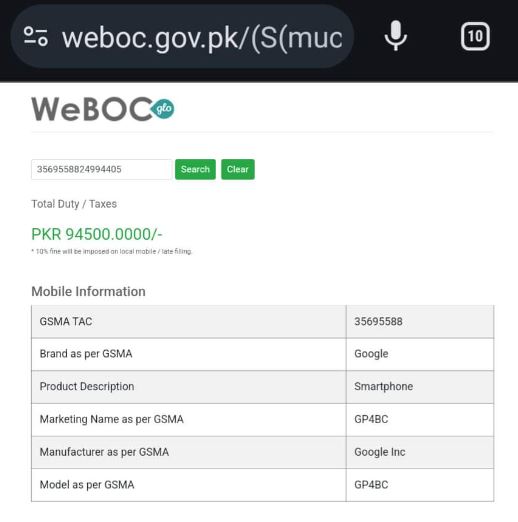

Many websites may mislead you with a non-existent PTA tax calculator. Instead, use the FBR Mobile Device Duty Information on the weboc website. Enter your IMEI number there to view and pay the required tax. You can access it directly through this link. After opening the link, click on the highlighted section marked with red box.

Enter your IMEI number and the Total PTA Tax or Duties will be displayed on your screen, as shown in the image below.

Conclusion

In conclusion, understanding and calculating PTA taxes for your mobile device in Pakistan is essential to ensure its proper registration and functionality. By following this guide, you can easily navigate official government websites, use the PTA Tax Calculator, and check your device’s tax status. Stay informed about the latest tax rates and use reliable resources like the FBR Mobile Device Duty Information to avoid any issues. With these steps, you can seamlessly comply with PTA regulations and enjoy uninterrupted use of your new phone.

FAQs

How many mobiles can be registered duty-free on one Passport?

You can register one mobile phone duty-free on a single Passport. This policy is aimed at facilitating travelers and ensuring that individuals do not abuse the duty-free allowance.

Read more: