Filing income tax returns can be very beneficial for students and housewives in Pakistan. The tax-free income slab is 600k PKR per annum. Here’s a comprehensive guide to understanding and filing income tax returns for those in these categories.

Nill Returns:

Students and housewives can file “Nil Returns” under one condition: they must not have a bank account or an e-wallet in their name. Nil returns essentially mean zero income tax filing.

Nill returns is zero income tax filing in simple terms.

Procedure:

- Login to the IRIS Web Portal:

- If you do not have an account, you can find many helpful videos online that guide you through the registration process.

- File Zero Income and Assets:

- In this category, you do not show any type of income or assets. Everything is set to “zero,” and tax returns are submitted to the Federal Board of Revenue (FBR) through the IRIS portal.

- Submit Nil Returns:

- Once you have entered all the necessary details, you submit the returns.

Are Nil Returns Beneficial?

- If you do not have a bank account and cannot claim any benefits, Nil returns are generally not advantageous.

Income Tax Returns:

For students and housewives with a bank account, filing income tax returns can be quite beneficial, especially if your income does not exceed the tax-free slab of 600k PKR. Here is a step-by-step guide:

Step 1: Log in to the IRIS Web Portal

- Go to the IRIS web portal.

- If you do not have an account, follow an online tutorial video for assistance in creating one.

Step 2: File Your Income Tax Returns

- Click on the blue box labeled “File your income tax returns.”

- Select the tax year (e.g., the current year is “2023”). This step is also detailed in many online help videos.

Step 3: Enter Your Income

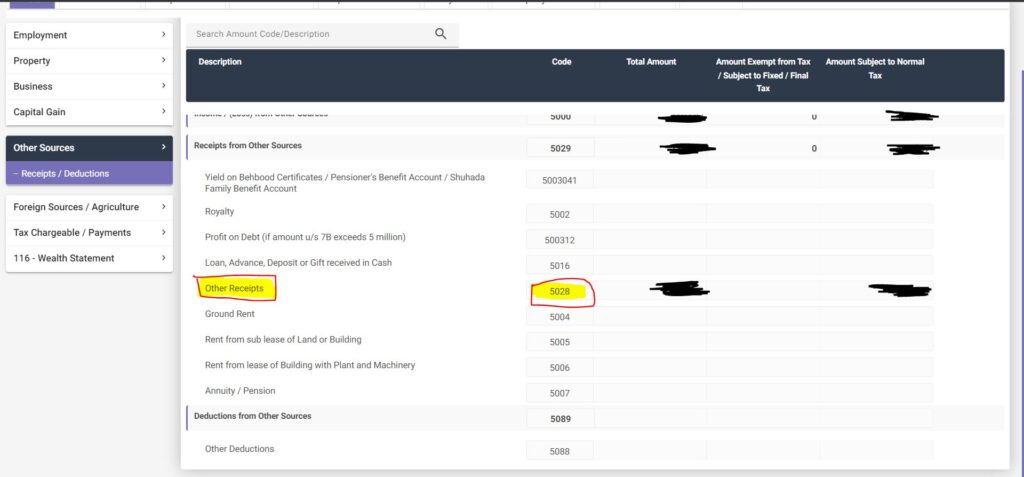

- Select “Other Sources” from the left column.

- Click on “Receipts and Deductions.”Take your bank statement and calculate the total credit, debit, and the difference.

- Ensure the total credit amount does not exceed 600k PKR.

- Type the credit amount in “Other Receipts” (Code: 5028). This will be considered your income.

- Click “Calculate” on the top right corner.

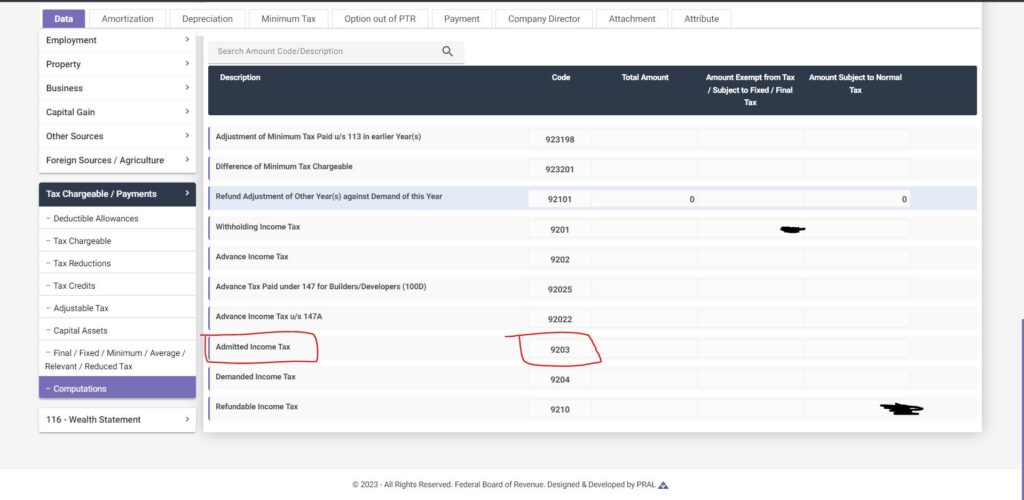

Step 4: Tax Chargeable Payments

- Click on “Tax Chargeable Payments.

- ”Select “Computation.”

- Scroll down to ensure your admitted tax is zero (Code 9203).

- There should be nothing written against this code.

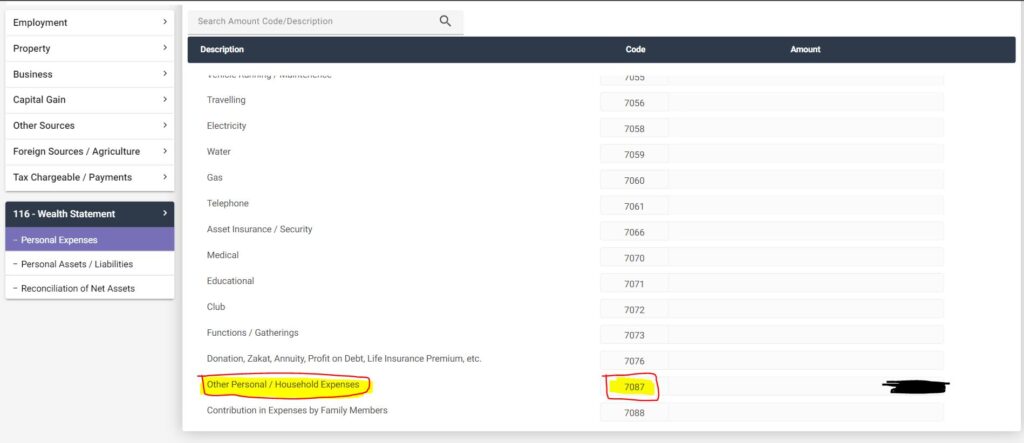

Step 5: Wealth Statement

Wealth Statement à Personal Expenses à Add all the credit amount into Code: 7087.

- Personal Expenses: Add all the credit amounts into Code: 7087.

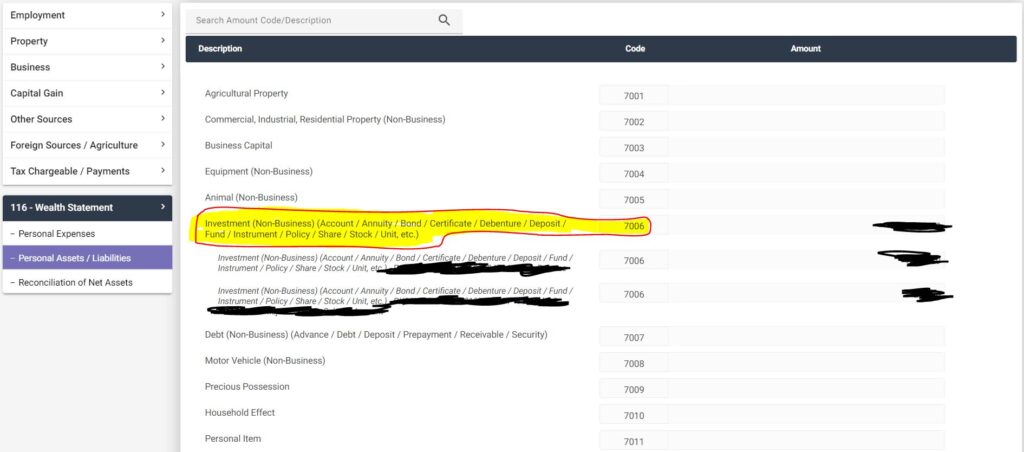

- Assets and Liabilities: Click on the (+) sign next to Code: 7006 and enter your bank balance along with the account number and bank name.

- Add the difference amount into Code 7006.

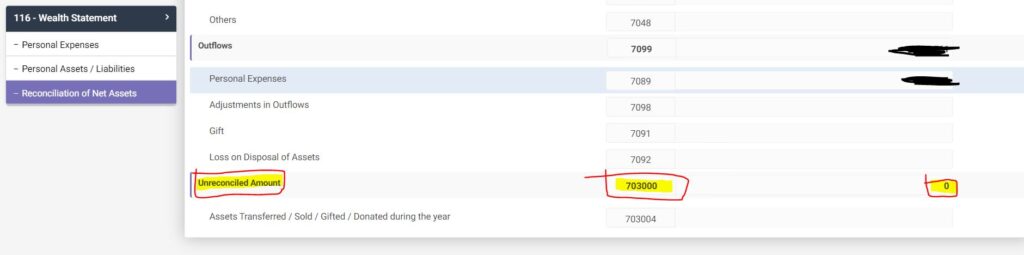

Step 6: Reconciliation of Net Assets

- Ensure that the unreconciled amount is zero (Code: 70300).

- Once verified, you are ready to submit your tax returns.

Benefits of Filing Income Tax Returns

- Financial Transparency:

- Maintaining a record of your financial transactions ensures transparency and aids in financial planning.

- Creditworthiness:

- Regularly filing tax returns enhances your creditworthiness, making it easier to secure loans and financial products.

- Legal Compliance:

- Filing tax returns ensures that you are compliant with tax laws, avoiding potential legal issues or penalties.

- Claiming Refunds:

- If you have overpaid taxes, filing returns allows you to claim refunds.

- Government Benefits:

- Being a filer can make you eligible for various government benefits and schemes.

Common Mistakes to Avoid

1. Incorrect Income Reporting:

- Ensure that you accurately report your income. Misreporting can lead to penalties and legal issues.

2. Ignoring Deductions:

- Make sure to claim all applicable deductions. This can significantly reduce your taxable income and increase your refund.

3. Late Filing:

- File your returns on time to avoid late fees and penalties. The deadline for filing returns is usually June 30th of each year.

4. Not Keeping Records:

- Maintain proper records of all your financial transactions, receipts, and bank statements. This is crucial in case of an audit or verification by the tax authorities.

Filing Assistance and Resources

1. Professional Help:

- Consider seeking assistance from a tax professional or accountant. They can help you navigate the complexities of tax filing and ensure accuracy.

2. Online Resources:

- Utilize online resources and tutorials available on the FBR website and other platforms. These can provide step-by-step guidance on filing your returns.

3. FBR Helpline:

- The FBR offers a helpline for taxpayers. If you have any queries or need assistance, you can contact them for support.

Conclusion

Filing income tax returns, whether as nil returns or showing actual income, can be beneficial for students and housewives in Pakistan. While nil returns might not be advantageous for those without a bank account, filing regular income tax returns ensures financial transparency, enhances creditworthiness, and keeps you legally compliant. Always make sure to follow the correct procedure and consult with a tax professional if needed to maximize your benefits.

By staying informed and proactive, you can navigate the tax filing process with ease and take advantage of the benefits it offers.

Also Read!

Pingback: Full Guide to Property Tax in Pakistan 2024 - DDC