Debt investment is a financial strategy that originated in the USA, where investors take out large loans over an extended period. The objective is to leverage the power of compounding interest to generate significant returns. While this method works well in the USA, the question arises: “Is it applicable in Pakistan as well?” This article provides a brief guide to debt investment in Pakistan and explores its feasibility.

How Debt Investment Works in the USA?

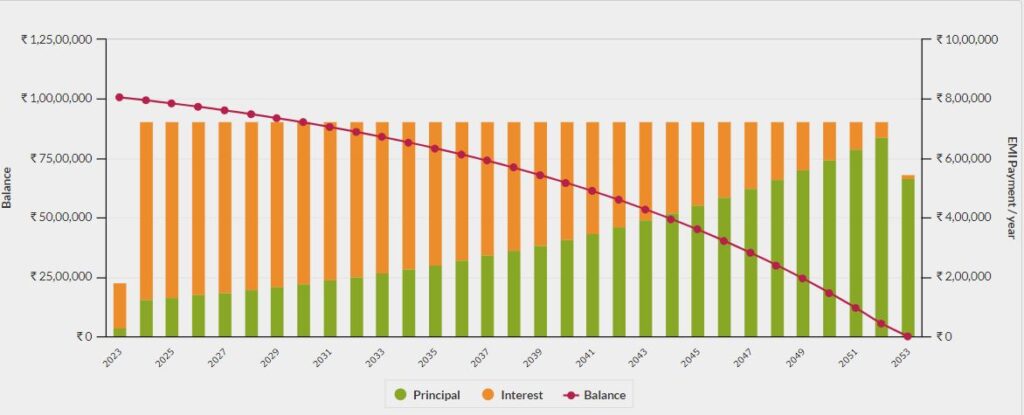

A common example among investors involves taking a $100,000 loan at a 6% interest rate over 30 years. This $100,000 is then invested at a 6% return rate. At the end of the 30 years, the total repayment amounts to $215,000, while the compounded returns total $515,000. This results in a net gain of approximately $300,000. The graph below illustrates how the monthly EMI decreases over time, with the remaining amount being reinvested to compound further.

In the USA, citizens can start benefiting from compounding from Year 1. But can Pakistanis do the same? Let’s explore this further.

Graph of USA:

Debt Investment Challenges in Pakistan

High-Interest Rates:

The primary challenge for debt investment in Pakistan is the high-interest rates. In the USA, investors can secure loans and achieve returns that match or exceed the interest rates. The average rental yields in the USA range from 5-8%, and after paying interest, the remaining returns can be invested in 401k plans or other compounding options. American investors also have access to various other investment opportunities.

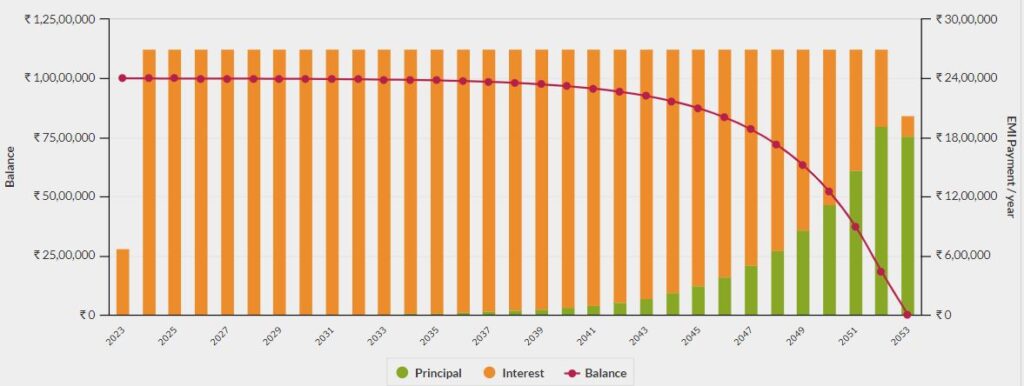

Graph of Pakistan:

Currently, banks offer loans at a whopping 26-28% interest rate. In this case, the investor cannot even think about compounding. At this rate, the total amount to repay is equal to 810k$. Where 710k$ is just the interest amount. In addition to this, there is no way to generate returns equal to 26-28% using any of the asset classes. Let it be the money markets, equity or real estate. Look at the graph below. For the first 20 years, the investor will be paying from his own pocket to pay the monthly EMI. There will be no compounding for 20 years. For compounding to work, the monthly EMI, must be lower than the monthly return.

Current Scenario in Pakistan

Currently, banks in Pakistan offer loans at staggering interest rates of 26-28%. Under these conditions, an investor cannot even think about compounding. At this rate, the total repayment amount for a loan of $100,000 would balloon to $810,000, with $710,000 solely constituting interest.

Moreover, there are no asset classes in Pakistan—be it money markets, equities, or real estate—that can consistently generate returns of 26-28%. The graph below depicts that for the first 20 years, an investor would be paying out of their own pocket to cover the monthly EMI, with no compounding benefits. For compounding to be effective, the monthly EMI must be lower than the monthly return.

Alternative Investment Options

Given the high interest rates and the infeasibility of debt investment in Pakistan, investors should consider alternative options that offer compounding benefits without the burden of exorbitant interest rates.

1. Compounding Mutual Funds: Mutual funds that offer compounding benefits are a viable alternative. These funds reinvest dividends to purchase more shares, thus compounding the investor’s returns over time.

2. Compounding in Stocks: Investing directly in stocks that pay dividends can also be a good strategy. Reinvesting the dividends to purchase additional shares allows for the benefits of compounding without the need for taking out loans.

3. Real Estate Investments: Although real estate in Pakistan does not offer returns as high as the interest rates on loans, investing in rental properties can still provide steady income and potential appreciation in value over time.

4. Savings and Fixed Deposits: While the returns on savings and fixed deposits are lower, they are risk-free and offer guaranteed returns. These options can be suitable for conservative investors.

Using an EMI Calculator

Before considering any loan for investment purposes, it’s crucial to use an EMI calculator to understand the monthly repayments and total interest payable. This tool can help investors make informed decisions by clearly showing the financial implications of taking out a loan.

Conclusion

Debt investment is not a viable option within Pakistan’s economic ecosystem due to the prohibitive interest rates. Investors should avoid this strategy and instead focus on compounding mutual funds, direct stock investments, or other safer investment avenues. Utilizing an EMI calculator can further aid in making sound financial decisions by highlighting the true cost of debt.

Final Thoughts

Investing wisely requires understanding the market conditions and the financial products available. In Pakistan, avoiding high-interest debt and seeking alternatives that offer compounding benefits can lead to more sustainable and profitable investment outcomes. Always consult with a financial advisor to tailor investment strategies to your specific financial goals and risk tolerance.